Car Insurance 2002 Honda Civic Si Hatchback Teenager Liable

2002 Honda Civic Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

| Jeffrey Johnson graduated summa cum laude from the University of Baltimore School of Law and has worked in legal offices and nonprofits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman University and worked in film, education, and publishing. His professional writing has appeared on sites like The Manifest and Vice, and he is the author of a novel ... Full Bio → | Written by |

UPDATED: Nov 24, 2021

Advertiser Disclosure

It's all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don't influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

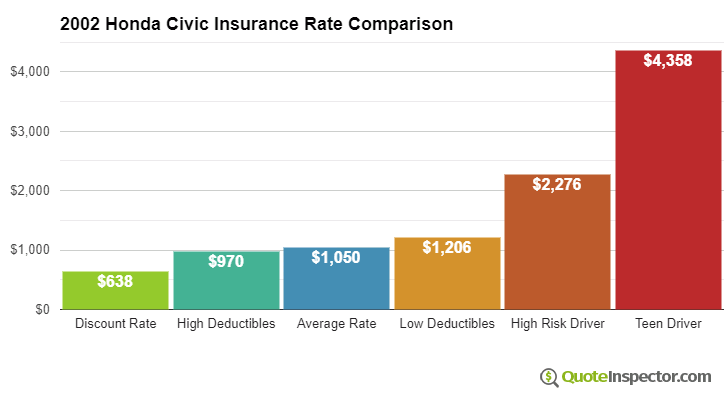

Average insurance rates for a 2002 Honda Civic are $1,002 a year for full coverage insurance. Comprehensive insurance costs around $120 a year, collision insurance costs $198, and liability insurance costs $504. Buying a liability-only policy costs as little as $564 a year, and high-risk insurance costs $2,170 or more. Teenage drivers receive the highest rates at up to $4,190 a year.

Annual premium for full coverage: $1,002

Rate estimates for 2002 Honda Civic Insurance

Comprehensive $120

Collision $198

Liability $504

Rate data is compiled from all 50 U.S. states and averaged for all 2002 Honda Civic models. Rates are based on a 40-year-old male driver, $500 comprehensive and collision deductibles, and a clean driving record. Remaining premium consists of UM/UIM coverage, Medical/PIP, and policy fees.

Price Range by Coverage and Risk

For a middle-aged driver, prices range range from as low as $564 for basic liability insurance to a high of $2,170 for a high risk driver.

Liability Only $564

Full Coverage $1,002

High Risk $2,170

View Chart as Image

These differences illustrate why it is important for drivers to compare rates for a specific zip code and risk profile, rather than relying on average rates.

Use the form below to get rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Recommended Companies for Cheap 2002 Honda Civic Insurance

Searching Companies

Expensive car insurance can overdraw your bank account and put a big crunch on your finances. Comparison shopping is free and is an excellent way to make sure you're not throwing money away. With so many options, it can be hard to find the most cost effective insurance company.

It's a good idea to compare rates at least once a year since insurance rates fluctuate regularly. Despite the fact that you may have had the best deal for Civic coverage a couple years back you can probably find a better price now. There is a lot of wrong information about car insurance online but we're going to give you some great ways to stop overpaying for insurance.

The purpose of this article is to let you in on the best way to quote coverages and some tricks to saving. If you currently have car insurance, you should be able to save some money using these tips. Vehicle owners just need to understand how to buy auto insurance over the internet.

Cut your premium with these six discounts

Insuring your vehicles can cost a lot, but you can get discounts that you may not know about. Certain discounts will be triggered automatically at quote time, but a few must be specifically requested before you will receive the discount. If they aren't giving you every credit available, you are paying more than you should be.

- Passive Restraint Discount – Factory air bags or motorized seat belts may earn rate discounts up to 30%.

- Seat Belts Save more than Lives – Requiring all passengers to use their safety belts can save 10% or more off your PIP or medical payments premium.

- Anti-lock Brakes – Anti-lock brake equipped vehicles can reduce accidents and will save you 10% or more.

- Early Signing – Some companies give discounts for switching to them prior to your current policy expiring. This can save 10% or more.

- Homeowners Pay Less – Owning a house may earn you a small savings because of the fact that having a home demonstrates responsibility.

- Drive Safe and Save – Drivers who avoid accidents may receive a discount up to 45% less for Civic coverage than drivers with accident claims.

As a disclaimer on discounts, some credits don't apply to all coverage premiums. Most only reduce the cost of specific coverages such as physical damage coverage or medical payments. So even though they make it sound like having all the discounts means you get insurance for free, you won't be that lucky. But any discount will bring down your overall premium however.

A partial list of companies that may have these benefits are:

- GEICO

- Auto-Owners Insurance

- American Family

- Esurance

- Progressive

- State Farm

- AAA

It's a good idea to ask all companies you are considering how you can save money. Some discounts might not be offered in every state.

Finding Car Insurance

Finding cheaper 2002 Honda Civic car insurance prices is not a difficult process. You just need to invest a little time to get quotes online with multiple companies. It is quite easy and can be accomplished in several different ways.

- The recommended way consumers can make multiple comparisons is to use a rate comparison form like this one (opens in new window). This method keeps you from doing a different quote for every car insurance company. One form submission gets you coverage quotes direct from many companies.

- A more time consuming way to get comparison quotes consists of going to the website for each individual company to request a price quote. For examples sake, we'll assume you want rates from Farmers, Progressive and Liberty Mutual. To get rate quotes you would need to go to every website and enter your information, which is why most consumers use the first method.

It's your choice how you get your quotes, but make darn sure you compare exactly the same coverages for every company. If you compare different limits and deductibles on each one then you won't be able to decipher which rate is best. When it comes to buying the best car insurance coverage, there is no perfect coverage plan. Everyone's needs are different so your insurance needs to address that. Here are some questions about coverages that could help you determine whether your personal situation could use an agent's help. If you don't know the answers to these questions but a few of them apply then you might want to talk to a licensed insurance agent. To find lower rates from a local agent, simply complete this short form. It is quick, free and can provide invaluable advice. Learning about specific coverages of your insurance policy can help you determine appropriate coverage for your vehicles. Policy terminology can be confusing and reading a policy is terribly boring. These are the usual coverages offered by insurance companies. Auto liability insurance – Liability insurance provides protection from injuries or damage you cause to other's property or people. It protects YOU from legal claims by others. Liability doesn't cover your own vehicle damage or injuries. Liability coverage has three limits: bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You commonly see limits of 25/50/25 that means you have a limit of $25,000 per injured person, a limit of $50,000 in injury protection per accident, and property damage coverage for $25,000. Some companies may use a combined single limit or CSL which combines the three limits into one amount without having the split limit caps. Liability can pay for claims such as medical expenses, pain and suffering, loss of income, structural damage and medical services. How much liability coverage do you need? That is a personal decision, but consider buying as large an amount as possible. Comprehensive (Other than Collision) – Comprehensive insurance coverage pays for damage that is not covered by collision coverage. A deductible will apply and then insurance will cover the rest of the damage. Comprehensive can pay for things like vandalism, hail damage, hitting a deer and a tree branch falling on your vehicle. The highest amount your insurance company will pay is the market value of your vehicle, so if it's not worth much more than your deductible consider dropping full coverage. Collision coverages – Collision coverage pays for damage to your Civic caused by collision with another car or object. You will need to pay your deductible then the remaining damage will be paid by your insurance company. Collision can pay for things like sustaining damage from a pot hole, rolling your car and hitting a parking meter. Collision is rather expensive coverage, so consider removing coverage from older vehicles. It's also possible to bump up the deductible to save money on collision insurance. Protection from uninsured/underinsured drivers – Uninsured or Underinsured Motorist coverage protects you and your vehicle's occupants when the "other guys" either have no liability insurance or not enough. This coverage pays for injuries to you and your family and also any damage incurred to your Honda Civic. Since a lot of drivers only carry the minimum required liability limits, their liability coverage can quickly be exhausted. That's why carrying high Uninsured/Underinsured Motorist coverage is a good idea. Usually the UM/UIM limits do not exceed the liability coverage limits. Medical expense insurance – Personal Injury Protection (PIP) and medical payments coverage pay for bills for things like ambulance fees, nursing services and surgery. The coverages can be used in conjunction with a health insurance program or if you lack health insurance entirely. Medical payments and PIP cover both the driver and occupants in addition to being hit by a car walking across the street. Personal Injury Protection is only offered in select states but can be used in place of medical payments coverage Discount 2002 Honda Civic insurance is possible from both online companies and also from your neighborhood agents, and you should compare price quotes from both so you have a total pricing picture. Some insurance companies may not provide the ability to get a quote online and these smaller companies work with independent agents. We just showed you some good ideas how you can save on insurance. The key thing to remember is the more times you quote, the higher your chance of finding lower rates. Drivers may discover the lowest rates come from a smaller regional carrier. Smaller companies may have significantly lower rates on certain market segments than their larger competitors like GEICO and State Farm. When trying to cut insurance costs, make sure you don't skimp on coverage in order to save money. There are many occasions where an insured cut full coverage and discovered at claim time that a couple dollars of savings turned into a financial nightmare. The proper strategy is to buy the best coverage you can find for the lowest price while not skimping on critical coverages. For more information, feel free to visit the articles below: To start shopping for 2002 Honda Civic insurance rates, enter your ZIP code in our free tool below to find the best 2002 Honda Civic price in your area. Enter your zip code below to view companies that have cheap auto insurance rates. Is a 2002 Honda Civic a good car? 2002 Honda Civic safety ratings and features are important to insurers when they calculate rates. The 2002 Honda Civic is a little outdated on safety features as it lacks features like back-up cameras, although it has all the standard airbags. The Insurance Institute for Highway Safety (IIHS) has also only done a moderate overlap front crash test on the 2002 Honda Civic (normally six different crash tests are performed). However, the moderate overlap front crash test did earn a good rating, which is the highest rating possible. The 2002 Honda Civic is a small car. According to the IIHS, the Honda Civic's liability losses are average, which means the 2002 Honda Civic will have average rates. To see how the 2002 Honda Civic's rates compare to other small cars' rates, view the vehicles below. Start comparison shopping for the best 2002 Honda Civic insurance cost in your area today by entering your ZIP code in our free tool. References What is the best insurance coverage?

Auto insurance 101

A fool and his money are soon parted

Free Auto Insurance Comparison

Secured with SHA-256 Encryption

What are the safety ratings of the 2002 Honda Civic?

2002 Honda Civic Compared Against Other Vehicles in the Same Class

Car Insurance 2002 Honda Civic Si Hatchback Teenager Liable

Source: https://www.quoteinspector.com/2002-honda-civic-compare-insurance-quotes/